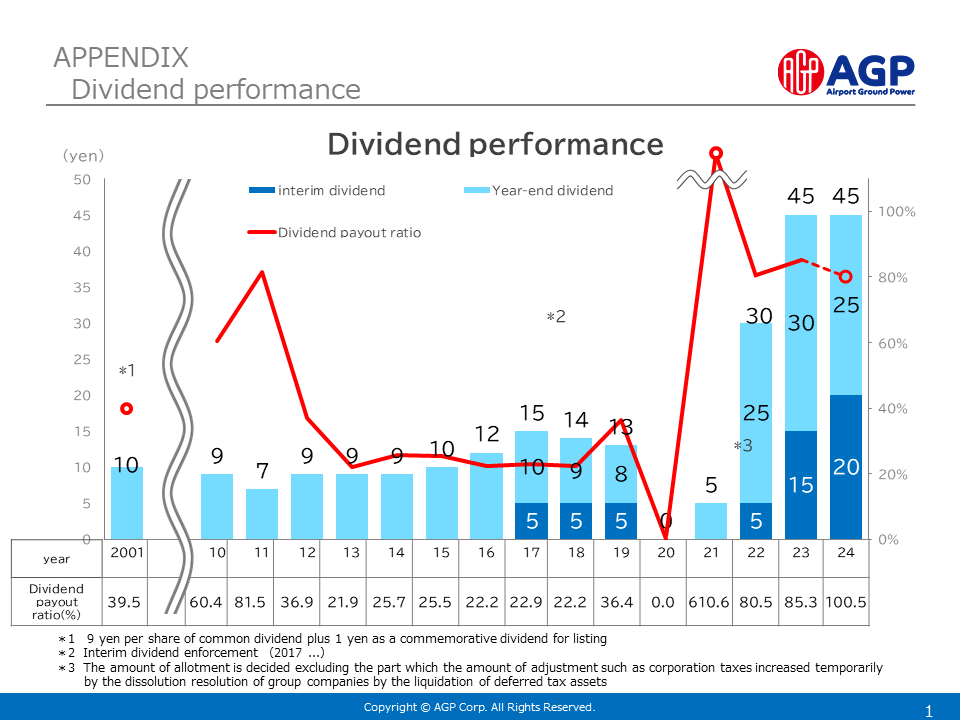

Shareholder Returns Policy

We recognize that providing stable and continuous returns to our shareholders is one of our most important tasks, and we aim to pay out dividends twice a year (interim and year-end), based on a comprehensive assessment of our business performance and financial situation, while ensuring sufficient internal reserves to actively and flexibly strengthen our business base and make strategic investments.

In addition, we aim to increase shareholder value by increasing earnings per share (EPS) through sustainable growth, and to further enhance returns to shareholders, we will actively work to increase dividends and repurchase shares, aiming for a total shareholder return ratio of 100% or more during the period of the medium-term management plan from fiscal 2022 to fiscal 2025.

Date of record for dividend rights

| Interim dividend | Year-end dividend | |

|---|---|---|

| Vesting Date | September 30 | March 31st |

Trends in dividends per share and dividend payout ratio

Terms of Service

The content of this data is based on the earnings report. Although considerable care has been taken in converting the data for publication, please note that there is a possibility of errors occurring in the information due to artificial tampering by a third party, mechanical defects due to equipment malfunction, or other acts of God. For details of information related to earnings, etc., please check the earnings report and other materials.